Why Has Copy Trading Become a Smart Choice?

Copy trading is one of the most modern approaches in the financial and cryptocurrency markets. It allows users to automatically follow and replicate professional traders’ actions — a truly social trading solution.

Traditional trading requires knowledge, time, and emotional control. Many beginners lack the experience or availability to analyze markets effectively.

That’s exactly why copy trading systems were created — to give users a simple, automated way to learn and trade simultaneously while staying in control of risk.

This guide explains copy trading from basics to advanced methods and highlights why Traia’s platform is fundamentally different from ordinary solutions.

What Is Copy Trading? (Simple Explanation)

Copy trading is a method that links your trading account to a professional trader’s account. Whenever the trader opens or closes a position, the same action is mirrored in your account — scaled based on your capital and risk preferences.

In simple terms:

- You don’t trade manually

- You choose a verified trader

- The system copies their trades automatically

This process combines learning with automation — a major advantage compared to traditional or manual trading.

How Does Copy Work? (Step by Step)

1. Choosing a Trader

On a <strong>copy trading platform, traders display transparent data such as:

- Historical performance

- Risk level

- Drawdown percentage

- Trading strategy

2. Setting Risk Parameters

You define how much capital to allocate and control your personal risk.

Modern auto trading systems like Traia let you adjust trade size and stop copying anytime.

3. Auto Trade Execution

Once configured, each position from your chosen trader is executed in your account automatically.

Every trade opens and closes in real time — no manual effort needed.

Benefits of Copy Trading

✅ Accessible for beginners

✅ Saves time and simplifies learning

✅ Trades follow proven strategies

✅ Builds real‑world experience

✅ Diversifies trading portfolios

Risks and Limitations

Even efficient copy trade platforms can’t eliminate risk.

- Market losses are possible

- Past performance doesn’t ensure future profits

- Choosing traders based only on short‑term gains can increase exposure

Remember: <strong>copy trading is a risk‑management tool, not a profit guarantee.

Common Mistakes to Avoid

- Following traders only for short‑term results

- Allocating all capital to one account

- Ignoring drawdown and volatility

- Closing trades emotionally

- Lacking a diversified strategy

Pro Tips for Successful Copy Trading

- Focus on consistent results, not high returns

- Split capital among several traders

- Update and monitor risk settings

- Treat social trading as part of your larger investment approach

How Copy Trading Works in Traia

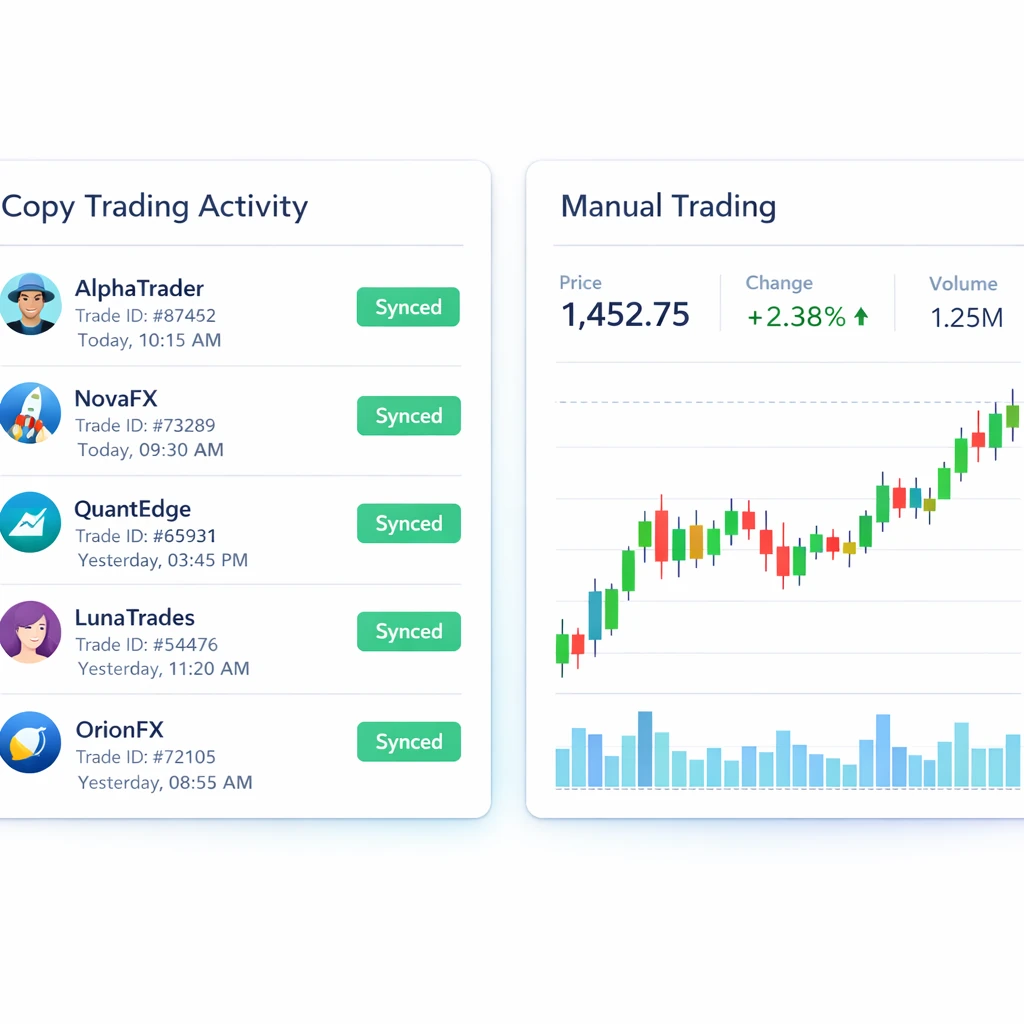

Traia offers a smart, transparent <strong>copy trading experience where users follow trading strategies automatically — no deep knowledge required.

👉 Learn more on the official Traia Copy Trade page

The Traia system is more than a copier. It’s designed for user control, intelligent automation, and clear performance reporting.

Key Features:

- Auto execution of copied trades

- Proportional position sizing

- Complete control of risk and balance

- Transparent performance stats

- Ideal for both beginners and professionals

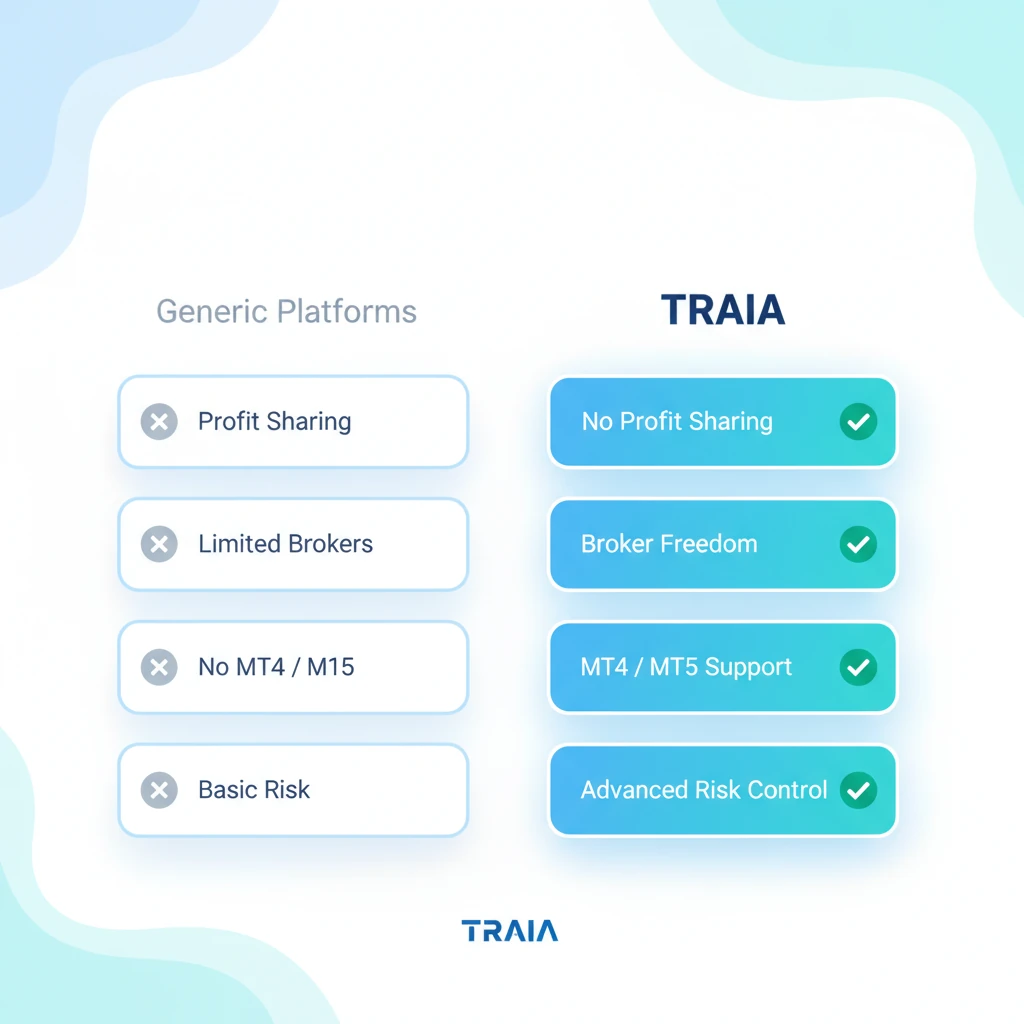

Why Traia Copy Trading Is Different

This is where Traia clearly stands apart.

1. No Profit‑Sharing Fees

Unlike many forex trading providers, Traia takes zero commission from your profit.

You either use it free through supported brokers or choose a simple subscription — totally transparent.

2. Works with Any Broker (MT4 / MT5)

Traia integrates with:

- Any broker or account type MetaTrader 4 , 5 platforms

Freedom to choose — no lock‑ins.

You can copy trade automatically while maintaining manual control.

See live trades, place your own positions, and learn from strategy execution simultaneously.

4. Smart Position Sizing

Traia automatically adjusts trade size by account balance for stable risk across small and large accounts.

5. True User‑Controlled Risk Management

Stop copying anytime, adjust exposure levels, or switch traders — total control, always.

Conclusion: Why Traia Leads in Copy Trading

Traia’s system is not just another mirror trading tool; it’s a complete capital and risk‑management solution.

At a glance:

- copy trading

- No profit sharing

- Broker‑independent

- hybrid

- Transparent statistics

- Full user control

👉 Start your journey with Traia:

Frequently Asked Questions (FAQ)

Is copy trading suitable for beginners?

Yes, when risk limits are defined clearly.

Is profit guaranteed?

No. No trading method can guarantee consistent profit.

Can I stop trading whenever I want?

Absolutely — Traia gives full account control.

Can I trade manually while copying others?

Yes, Traia allows manual and automated trading simultaneously.

Leave a Reply