How Profit Rate and Pip Rate Reveal Real Trading Skill on TRAIA

In Forex trading and especially Copy Trading, many users still judge traders based on a single metric: Win Rate.

While Win Rate may look attractive, it often hides critical risks such as poor risk management, volume-based manipulation, or unstable strategies.

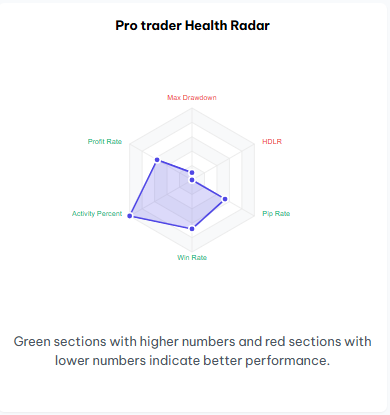

On TRAIA, every trader listed in the Copy Trade marketplace is evaluated using advanced performance metrics — including Profit Rate and Pip Rate — displayed visually inside the Pro Trader Health Radar.

👉 Explore the Copy Trading marketplace:

https://traia.app/copy-trade

What You See When You Click a Copy Trade Card on TRAIA

Each trader card on the Copy Trade page represents a real trading account.

When users click on a card, they are taken to a detailed trader analytics page that includes:

- Performance and profit statistics

- Risk and drawdown metrics

- Trade history and activity level

- Pro Trader Health Radar

This radar chart gives users a fast, transparent overview of a trader’s true quality.

Why Win Rate Is a Weak Standalone Metric

Win Rate simply shows how many trades closed in profit.

Example:

- 80 winning trades out of 100

→ Win Rate = 80%

However, Win Rate ignores:

- Trade size and leverage

- Loss magnitude

- Risk-to-reward structure

- Capital efficiency

As a result, a trader may have a very high Win Rate while exposing followers to serious hidden risk.

Profit Rate: Measuring Capital Efficiency

Profit Rate shows what portion of a trader’s total trading activity resulted in profit.

Profit Rate Formula

Profit Rate = Total Profit / (Total Profit + |Total Loss|)

Example

- Total Profit: $70

- Total Loss: $30

→ Profit Rate = 70%

Why Profit Rate Matters in Copy Trading

- Focuses on real money, not trade count

- Naturally reflects Risk / Reward

- Reduces volume-based distortion

- Ideal for ranking traders fairly

Profit Rate Interpretation

| Profit Rate | Meaning |

|---|---|

| < 50% | Losing strategy |

| 50–60% | Break-even |

| 60–70% | Healthy |

| 70–80% | Strong |

| > 80% | Possible hidden risk |

Pip Rate: Measuring Real Market Skill

Pip Rate is one of TRAIA’s most important analytical metrics.

Instead of measuring money or volume, Pip Rate measures how effectively a trader captures actual market movement.

Pip Rate Formula

Pip Rate = Positive Pips / (Positive Pips + |Negative Pips|)

📌 Pip Rate is calculated per trading symbol (EURUSD, XAUUSD, NAS100, etc.) and then averaged across all symbols.

Why Pip Rate Is Critical

- Pip structures differ across instruments

- Prevents distortion from one volatile asset

- Highlights true cross-market trading skill

What Pip Rate Reveals About Trader Style

Volume-Driven Traders

- High Profit Rate

- Low Pip Rate

- Profits generated mainly by large lot sizes

- Short price movements

- Higher slippage and drawdown risk

Skill-Driven Traders

- High Profit Rate

- High Pip Rate

- Profits generated by capturing real market moves

- Stronger risk control

- More stable for long-term Copy Trading

This distinction is clearly visible inside the Pro Trader Health Radar.

Pro Trader Health Radar Explained

The Pro Trader Health Radar visually summarizes a trader’s performance using key dimensions:

- Profit Rate → Capital efficiency

- Pip Rate → Market skill

- Win Rate → Trade consistency

- Drawdown metrics → Risk control

- Activity level → Behavioral stability

This allows users to evaluate traders in seconds instead of hours.

👉 View live trader analytics:

https://traia.app/copy-trade

When Is a Trader Truly Copy-Ready?

On TRAIA, a trader is considered suitable for Copy Trading only when the following align:

Copy-Ready Trader =

High Profit Rate

+ High Pip Rate

+ Reasonable Win Rate

+ Controlled Drawdown

+ Sufficient Trade History

+ Time Consistency

Strong performance without risk control is never enough.

Why TRAIA Uses Advanced Metrics

TRAIA is built around:

- Transparency

- Behavioral analytics

- Long-term sustainability

That’s why the platform prioritizes:

- Skill over volume

- Consistency over spikes

- Risk awareness over marketing numbers

Profit Rate and Pip Rate are core pillars of this evaluation system.

Final Thoughts

- ❌ High Win Rate alone does not define a good trader

- ✅ Profit Rate shows capital efficiency

- ✅ Pip Rate reveals true Forex trading skill

- ✅ Together, they enable smarter Copy Trading decisions

If you want to copy traders with real skill, controlled risk, and transparent performance, TRAIA gives you the tools to do it properly.

👉 Explore Copy Traders Now

https://traia.app/copy-trade

Leave a Reply